Might you Nevertheless Subtract Appeal into the second Financial?

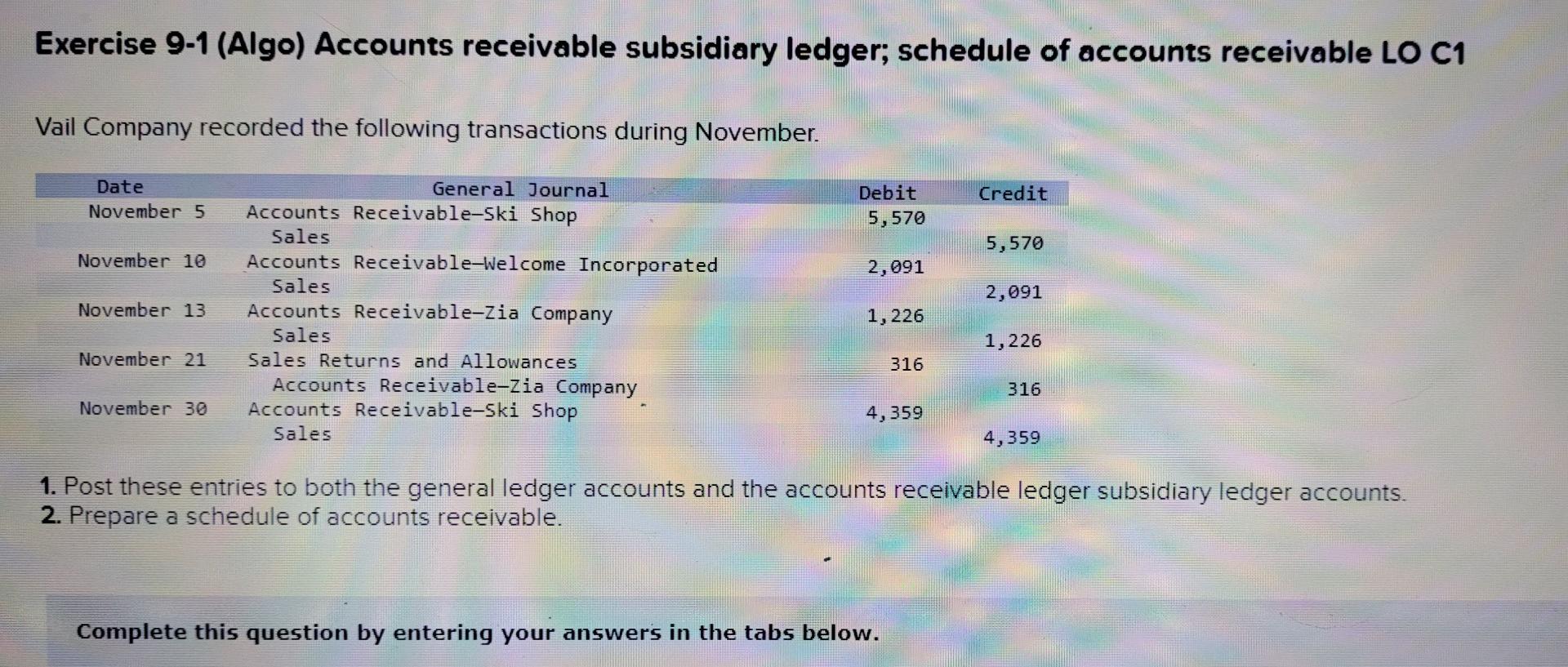

2019 is a huge season for tax gurus. Just after years regarding legislative close-stasis, the alterations wrought from the Tax Incisions and you will Jobs Act regarding 2017 possess motivated a quantity of client desire and you will wedding not viewed for a long time. In 2010 it seems that group, a bit without a doubt, keeps questions about how the fresh rules tend to affect their money tax bill and you will being among the most prominent inquiries we have viewed right here from the Brighton Jones is it:

Discover about three fundamental concerns that may see whether the eye reduced on the additional mortgages (whether home collateral 2nd mortgage loans otherwise mortgages with the an additional home) is actually allowable, and we will walk-through this type of below.

1. What is the money from the mortgage useful for?

From tax year 2018 (yields due ), only appeal paid for the acquisition indebtedness could be deducted. Consequently attention is just allowable should your mortgage is actually made use of possibly to track down, make, otherwise dramatically improve a central or second house. Like, interest to your property guarantee mortgage used to improve your cooking area to the current commercial countertops and you can sites-let products will still be allowable. Attention into the property equity loan used to see your ideal away from buying a classic sky-cooled Porsche 911, although not, won’t feel deductible.

That it restrict enforce no matter what when the mortgage got its start-there’s nothing grandfathered. For this reason, https://paydayloanalabama.com/bon-air/ desire you’re able to subtract on your own 2017 come back get back. For those who have property security home loan, you need to explore this matter with your taxation preparer to make certain that they are aware of the method that you used the funds from your own home collateral mortgage.

Observe that the purchase indebtedness need to affect our home one is employed to help you support the financial. Eg, appeal towards the home financing regularly purchase the next home you to is actually secured by the next house is deductible but focus toward a property collateral financing regularly buy an extra household you to try protected because of the taxpayer’s main residence is maybe not deductible. This might be a relatively unusual circumstances, but if it applies to your, you need to mention they in more breadth along with your income tax considered elite.

dos. How much total home loan debt is a good?

Prior to the 2018 income tax seasons, some body you can expect to subtract the interest into up to $step one,000,000 ($five-hundred,000 in the event the married processing individually) off qualifying debt, nevertheless the Tax Cuts and you can Services Work faster the utmost loan amount to $750,000 ($375,000 when the ount the was $750,000 ($375,000 in the event that married filing ount of interest paid back into the all of the mortgages to have a main or second house as long as the latest mortgages were used to have buy indebtedness as described a lot more than concerned one to. When your total dominating count outstanding is more than $750,000 ($375,000 when the married submitting alone), then chances are you ount of interest according to answer to new second question.

3. When did the loan originate?

If for example the financial started on the otherwise prior to , well done, you are grandfathered to the past taxation treatment and can even deduct focus to the up to $step one,000,000 ($five-hundred,000 when the partnered processing independently) out of mortgage dominating provided that the loan was utilized to acquire, generate, or considerably increase a main or next household. For loans originating immediately after , you can even merely subtract desire for the a mortgage principal away from up so you can $750,000 ($375,000 in the event the hitched processing independently).

Note, not, one to having you to definitely grandfathered financing cannot eliminate the fresh new finance to your the same condition. For example, for those who have $800,000 from a great mortgage dominant on the that loan one to originated into or prior to , you can’t after that take out a unique home loan to own $2 hundred,000 now and you will subtract desire to the full $step 1,000,000 away from prominent obligations-you would certainly be limited to subtracting just the attract on $800,000 out-of grandfathered mortgage debt.

Conclusion

The good news is you to definitely appeal on mortgage loans getting another home and you can home equity funds is nonetheless deductible. In the event just how much of these interest is allowable all hangs on what the fresh new finance were utilized to possess, simply how much prominent stays an excellent, if in case the newest finance began, as long as you bring you to definitely recommendations for the income tax top-notch, they will be able to make sure to receive the restrict financial appeal deduction possible.